How to use PayPal?

PayPal is a popular ewallet in the UK and worldwide. It has millions of users and is very convenient and easy to use. In this guide we will tell you how to use PayPal and also tell why we consider it the top ewallet in the UK.

To get started with PayPal, you need to first create an account with PayPal. Before we tell you how to do it, let’s look at the key benefits of PayPal.

PayPal benefits – Quick facts about PayPal

- No need to top up – You can link your bank card or account and pay directly without pre-loading funds.

- Fast online payments – PayPal remembers your details, so you don’t have to type in your card number every time.

- Increased security – Your card details stay with PayPal — they’re never shared with the merchant.

- One-click checkout – Especially useful on mobile or with repeat purchases.

- Buyer protection – If something goes wrong with a purchase, PayPal can help you get a refund.

- Widely accepted – PayPal is supported on most major websites, so you can use it almost anywhere online.

- Currency conversion – Pay in different currencies (PayPal will handle the exchange for you).

- Easy to track spending – You get clear records of what you’ve bought and when, in one place.

How to Register and Create a PayPal Account

- Email, bank account, card, mobile number

- Smartphone or laptop, internet

1. Head to PayPal’s Website

Go to paypal.com and click on the “Sign Up” button at the top right. You can also do this on your phone if that’s easier for you.

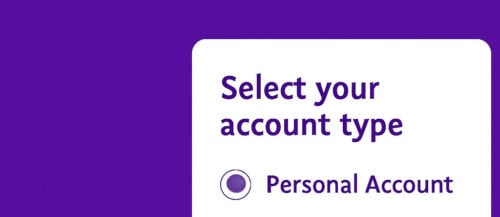

2. Select account type

You’ll be asked whether you want a Personal or Business account.

- Go with Personal if you’re just looking to shop, send money, or get paid back by friends.

- Choose Business if you’re selling something or want to accept payments in a professional name.

If you’re not sure, start with a personal account — you can always upgrade later.

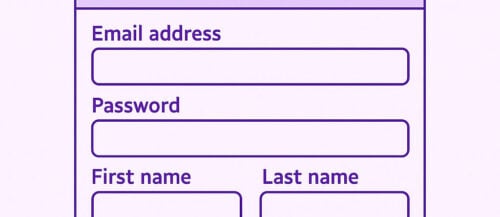

3. Fill In Your Details

This part’s straightforward. Just enter:

- Your email

- A secure password

- Your name, address, and phone number

Try to use accurate info here — PayPal may ask to verify your identity at some point, especially if you’re planning to withdraw money.

4. Confirm Your Email

PayPal will send you a confirmation link. Check your inbox, click the link, and boom — your account is now active.

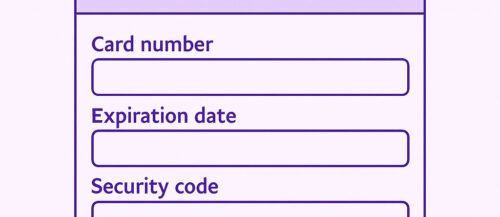

5. Link a Card or Bank Account

This is where PayPal gets really useful. Link your:

- Debit or credit card to pay instantly at checkout

- Or your bank account if you want to send or withdraw money directly

Don’t worry — your details stay with PayPal. You won’t have to type your card info at every store.

6. You’re All Set

Once your card or bank is linked, you’re good to go. You can shop online, send or receive money, or even set up recurring payments — all from one place.

You can also download the PayPal app to manage everything on the go. It works on both Android and iOS.

How and Where to use PayPal?

PayPal is one of the most widely accepted digital wallets in the UK — and for good reason. Once your account is set up, using it is both fast and secure. But where exactly can you use it?

Online shopping with PayPal

PayPal is accepted by most major e-commerce sites like eBay, ASOS, Argos, and hundreds more. You can also use it to pay for digital services such as Spotify, Netflix, and even food delivery apps like Uber Eats and Deliveroo. Since PayPal stores your card or bank details securely, you don’t have to enter them every time you make a purchase. That alone saves time — and adds a layer of protection.

But PayPal isn’t just for shopping. It’s also a popular way to send money to friends and family, split bills, or even receive payments for freelance work. You can use it via a web browser or the mobile app, making it flexible wherever you are.

Online Gambling with PayPal

In the UK, PayPal is a favourite payment method for many casino players. Some sites even offer instant registration with PayPal, meaning your details are automatically pulled from your PayPal account — no long forms needed. It’s fast, safe, and saves you from manually entering card information.

And when it comes to withdrawals, PayPal stands out again. Many casinos process PayPal payouts faster than bank transfers or card withdrawals. That’s why a lot of UK players are now choosing online casinos that accept PayPal.

Whether you’re shopping online, splitting dinner with a friend, or playing at a licensed UK casino, PayPal offers a simple and secure way to manage your money.

Why Casino Professor Recommends PayPal?

At Casino Professor, we’ve seen a lot of payment methods. Some good, some… let’s just say creative. But PayPal? It’s the real deal.

Only Works with Legit Casinos

- PayPal is picky. And we mean that in a good way.

- They only work with casinos that are fully licensed and follow the rules.

- So if a site accepts PayPal in the UK, it’s licensed by the UK Gambling Commission. Simple as that.

Safe & Secure

- PayPal takes security seriously.

- They use advanced encryption, fraud detection, and two-factor authentication.

- Basically, it’s safer than a wallet in your sock drawer.

Fast deposits & withdrawals

- Payouts with PayPal? Fast.

- Like almost instant fast — often within minutes once approved.

- No waiting days, no chasing support. Just your winnings, quickly.

No need to input card details

- You don’t have to type your card info at every casino.

- PayPal handles the payment behind the scenes.

- All your details stay private — just how it should be.

It’s Just Easy

- Using PayPal feels natural.

- Log in, click confirm, done.

- Even your nan could probably manage it (no promises though).

Why PayPal became so popular in the UK?

If you’re wondering why PayPal became such a household name in the UK, one word says it all: eBay.

In the early 2000s, eBay exploded in popularity across the UK. It became the go-to platform for buying second-hand goods, rare collectibles, electronics, and just about anything else you could imagine. And right alongside that boom was PayPal — which quickly became eBay’s preferred and later required payment method.

For thousands of UK users, their very first online transaction happened through eBay using PayPal. Sellers liked it because they got paid quickly. Buyers liked it because they didn’t need to send cheques, hand over bank details, or worry about getting scammed. PayPal’s Buyer Protection gave people confidence to shop with strangers — something that was still a big deal back then.

This partnership gave PayPal a huge early lead in trust and visibility. Once people had PayPal accounts for eBay, they started using them elsewhere too — for online shopping, sending money, and eventually even for online gaming.

Even after eBay and PayPal officially split in 2015, the connection had already done its job. PayPal had become deeply embedded in how Brits paid online.